Probiotics in Europe: consumer survey in 8 EU countries shows positive consumer perception and regulatory limitations

To monitor the evolution of European consumers’ opinions, trends and behaviours regarding probiotic foods and supplements, the International Probiotics Association – Europe commissioned the market research company 3Gem to carry out a survey with a representative sample. The evolution of European consumers’ opinions, trends and behaviours regarding probiotic foods and supplements shows a strong interest in overall health and well-being.

It also highlights the fact that consumers would like to be more informed on the labelling and in communications about probiotic food and food supplements, and about probiotic microorganisms in food and food supplements. This is one of the key findings of the consumer survey conducted by 3Gem and commissioned by IPA Europe.

The online survey was carried out in 8 European countries (Italy, Denmark, the Netherlands, Spain, Poland, Belgium, Germany and Sweden) on a total of 8000 consumers to assess people’s understanding of the probiotic offer currently on the market, and their use of probiotic foods and supplements in daily life. Download the Press Release

Background

We live in a time where a simple Google search for ‘probiotics products’ shows over 94 million hits. The probiotics market continuously expands with the globalization of online sales, and probiotics are increasingly popular and widely advertised on the Internet.

EU consumers, however, cannot be informed about the presence of probiotics in food and food supplements, because 15 years ago the European Commission guidance on the implementation of Regulation 1924/2006 stated that ‘contains probiotics/prebiotics’ should be considered a health claim per se. As a consequence, the term ‘probiotic’ cannot be used in labels and communication, even though the guidance is non-binding, but it is still considered as the reference for probiotics by the European Commission.

In recent years other interpretations have been developed by EU Member States, and since 2018, the situation has been evolving. Some EU countries issued national guidances allowing the use of the term, others are now more flexible on the topic. This increased use of the term ‘probiotic’ since 2018 is also reflected by the positive evolution of the probiotics market during the period 2018-2021.

Probiotics are popular, even people who do not use or buy probiotics know the term

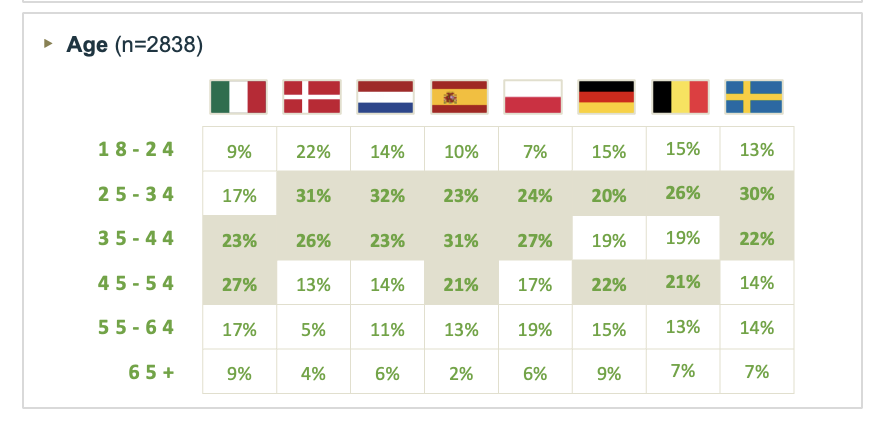

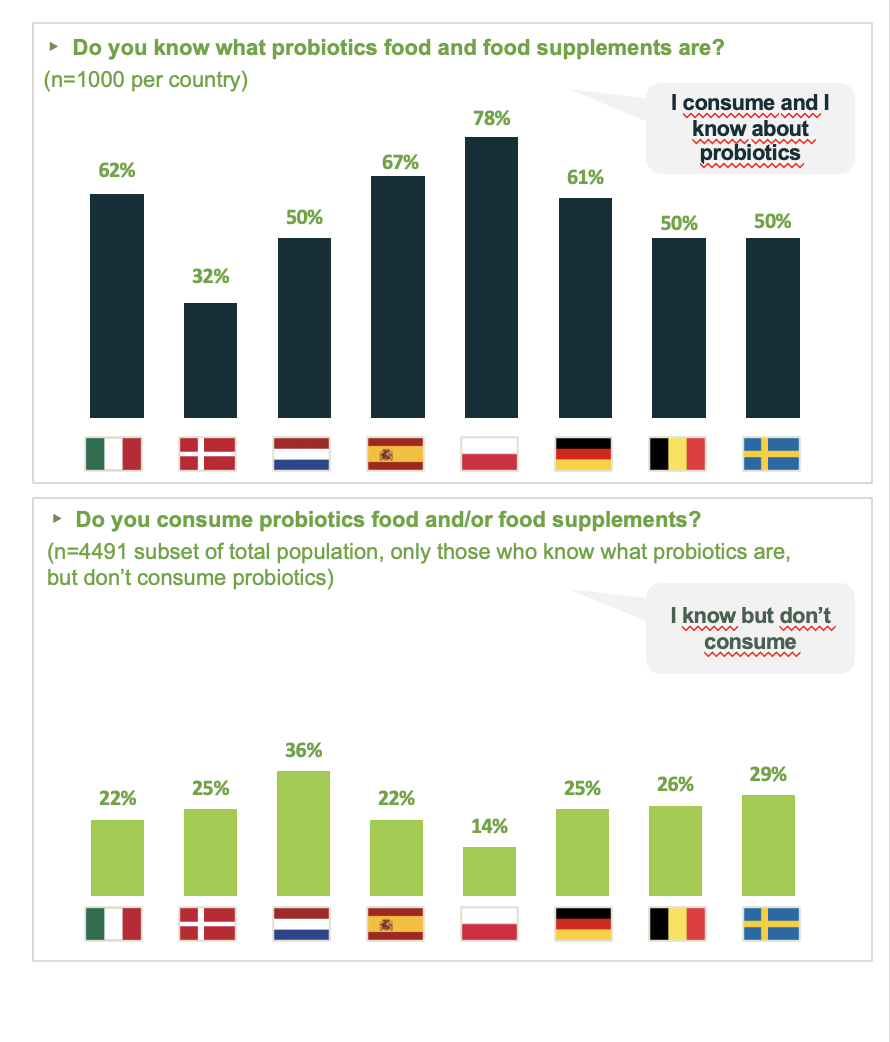

Women and men appear to consume probiotics almost equally and on average the consumption peak is in the 25-44 years old group. Overall, the clear result shown is that for the majority of consumers, the answer to “Do you know what probiotics and probiotic foods are?” is yes.

There’s a quite substantial set of people who know the word ‘probiotic’, even though they say that they do not consume them. This is probably due to the large presence of information on probiotics in online Search Engines on the web, mainly from commercial sources and news outlets. However, these sites often fail to paint a complete picture, so consumers may miss relevant information.

Consumers do not feel well informed that a product contains probiotics

Overall, the survey findings show that consumers across Europe have high familiarity with the word ‘probiotic’ but they would like to know more.

However, the most relevant information resulting from the survey is that in 7 out of 8 countries, consumers feel they are not informed about probiotics contained in products they find in the shops.

Poland is the only market with a bigger group of people feeling they are well informed (55% vs 45%), but even here we still see a high proportion (45%) of consumers that would like to know more.

‘Probiotics’ are part of lactic bacteria or live bacteria, but not all live bacteria are probiotics

Other terms such as live bacteria or live cultures are more known than the term probiotic. This is probably due to the fact that the term ‘probiotic’ is not allowed in most EU countries, which makes the consumers more familiar with the terms live bacteria and/or live cultures, rather than the term ‘probiotic’.

A very large portion of the consumers in Italy is familiar with ‘live cultures’ (89%). This is also due to the traditional use of this term associated with probiotic products in Italy.

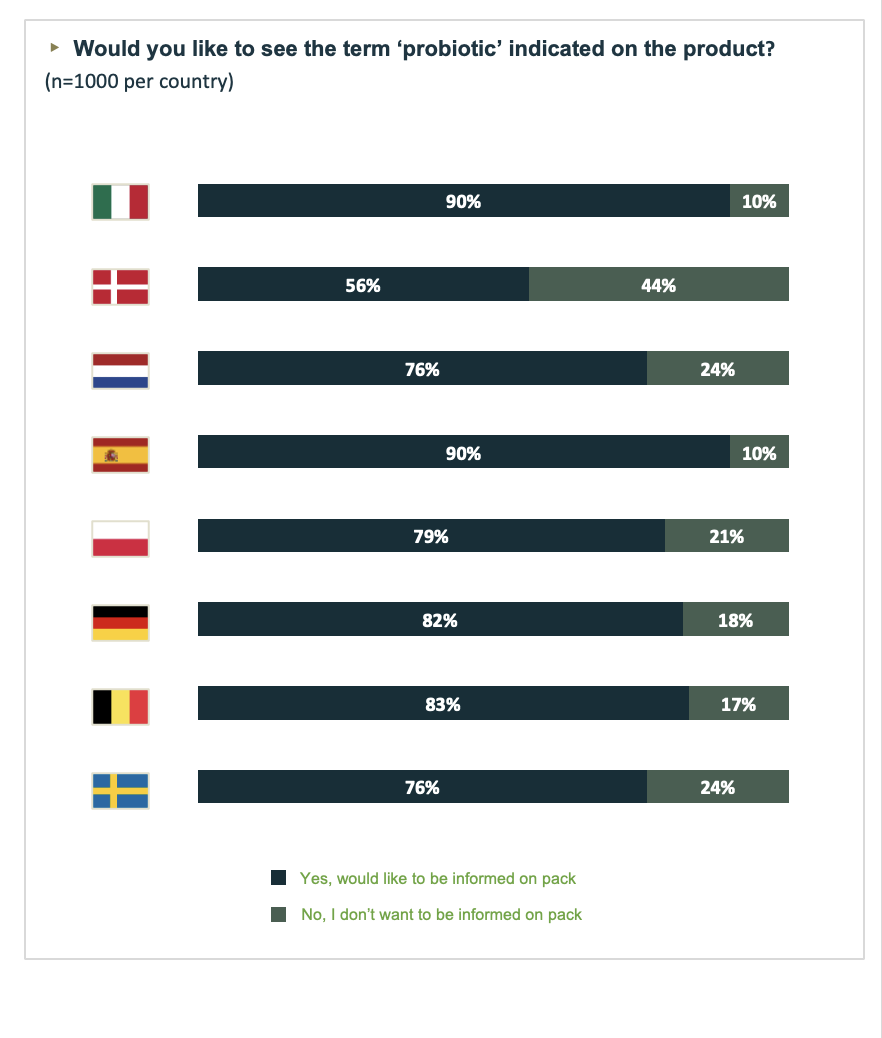

When food and supplements with probiotic microorganisms are available in shops, 79% of all tested market consumers would like to see the term ‘probiotic’ indicated on the product, e.g in the ingredient list or somewhere else on the packaging of food and food supplements, with Italy and Spain being the countries where the interviewed people feel strongest about the indication on the labels.

An opportunity to further educate consumers

Finally, the survey participants were asked what they think probiotics are useful for, and specifically “for what reasons do they consume probiotics”, if they had previously indicated that they do use them.

The result was that consumers are more informed about probiotics in countries that have allowed the use of the term for a longer time. People mainly refer to probiotics mentioning their beneficial effect on bacterial flora, digestion and the stomach.

Consumers that know what probiotic foods and food supplements are, and who also consume them, mention that their main driver is their overall health and wellbeing. Very often the indications to use probiotics come from healthcare professionals, which also explains why so many people are familiar with the category, however they find no correspondence when looking at product labels.

We can conclude that the need for a coherent EU regulatory approach for probiotics goes together with the opportunity to further educate consumers on the correct use of these micro-organisms. The high level of uncertainty for most probiotic health claims found online hinders the rational use of probiotics, leaving the field open to unsubstantiated allegations and misuse.

The detailed report will be published in October 2022.